As an independent contractor dealing with income taxes can be more complicated than a traditional employee. When you get paid taxes are not withheld from your payment, A W-9 Form is used to provide your necessary information to your employer. This form lets you send your social security or tax identification number.

What is a W-9 form?

The most common use of a W-9 form is to provide legal information to employers to receive a Form 1099 to file your taxes. W-9s forms are not sent to the IRS but given to employers only.

Who has to fill out a W-9?

As an independent contractor, you should fill out a W-9 form every time you do a job for which you are paid more than $600. At the end of the tax year, employers are required to send a 1099 Form, based off of the information provided on the W-9.

Since W-9 Forms are used to provide information, banks sometimes require them when opening new accounts.

If you invest the financial institution you invest with might also ask for a W-9 Form so they can submit a 1099 form to report interest income or proceeds from property sales.

In a situation where debt you owe is forgiven or canceled, you will need to provide a W9 so they can file a Form 1099C with the IRS.

A W-9 contains all of your important information, so it is crucial that you be careful with whom you provide them to. While you do need to provide them for various situations, be sure to only give them to individuals, institutions, or companies you know. If you are sent a W-9 in the mail and do not recognize the sender or believe the form to be suspicious, reach out to them for more information. You should also contact a tax professional to help you with the situation.

If you are a traditional employee at a company, you should never have to fill out a W-9, you would instead fill out a W-4 Form. If, for any reason, you are sent or given a W-9, be sure to talk to your employer to verify your type of employment, whether it is as an independent contractor or employee.

Where do you get a W-9?

Most often, when an employer needs you to fill out a W-9, they will provide it for you. In the case that a form is not provided or you need an additional form here.

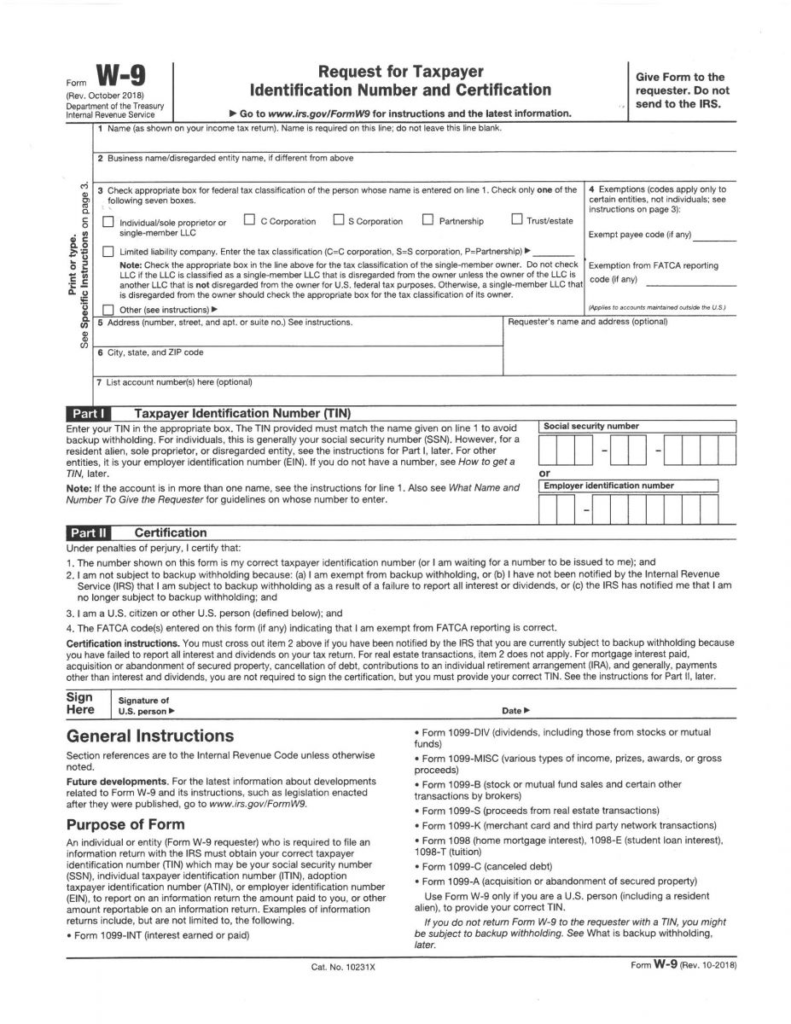

A W-9 is a one-page form that is easy to fill out here are step by step instructions on how to fill it out.

- Fill out your full legal name, as is written on your tax return.

- Fill out the name of your business. Only fill out this line if you operate a business.

- Select the type of business you run in this section. Your options in this section are:

- Individual/Sole Prop or Single Member LLC.

- C Corporation

- S Corporation

- Partnership

- Trust/Estate

5. & 6. Fill in your address

Part I

Fill out your personal social security number or Employer Identification Number in this section. If you have a business with employees or operate as a partnership or corporation, you most likely have an EIN.

Part II

In this portion, you sign and date and certify that all of the information you have entered is correct.

There is no official deadline for sending in a W-9, but you should fill them out as soon as possible after receiving them. Employers need them to send out Form 1099 to you and the IRS at the end of the tax year.

Dealing with W-9 and 1099 forms as an independent contractor or employer can be complicated, but it can be more comfortable with the help of experts. At FACT Professional Inc, we have the experience to help you with all your income tax needs.

Please Note: This post is to be used for informational purposes only, and it does not constitute legal, business, or tax advice. Each person should contact us directly or consult his or her own CPA, attorney, business advisor, or tax advisor with respect to matters referenced in this post. FACT Professional Inc. assumes no liability for actions taken in reliance upon the information contained herein.