If you use part of your home for business, you may be able to deduct expenses for the business use of your home. The home office deduction is available for homeowners and renters, and applies to all types of homes.

There are two methods to claim this expense on your Individual Tax Return

Simplified Option

This new simplified option can significantly reduce the burden of recordkeeping by allowing a qualified taxpayer to multiply a prescribed rate by the allowable square footage of the office in lieu of determining actual expenses.

The standard method has some calculation, allocation, and substantiation requirements that are complex and burdensome for small business owners.

This is not the method our firm uses, as it usually has less of a benefit to the taxpayer.

Regular Method

Taxpayers using the regular method, must determine the actual expenses of their home office. These expenses may include mortgage interest, insurance, utilities, repairs, and depreciation.

Generally, when using the regular method, deductions for a home office are based on the percentage of your home devoted to business use. So, if you use a whole room or part of a room for conducting your business, you need to figure out the percentage of your home devoted to your business activities.

Requirements to Claim the Home Office Deduction

Regardless of the method chosen, there are two basic requirements for your home to qualify as a deduction:

- Regular and exclusive use.

- Principal place of your business.

Regular and Exclusive Use

You must regularly use part of your home exclusively for conducting business. For example, if you use an extra room to run your business, you can take a home office deduction for that extra room.

Principal Place of Your Business

You must show that you use your home as your principal place of business. If you conduct business at a location outside of your home, but also use your home substantially and regularly to conduct business, you may qualify for a home office deduction.

For example, if you have in-person meetings with patients, clients, or customers in your home in the normal course of your business, even though you also carry on business at another location, you can deduct your expenses for the part of your home used exclusively and regularly for business.

You can deduct expenses for a separate free-standing structure, such as a studio, garage, or barn, if you use it exclusively and regularly for your business. The structure does not have to be your principal place of business or the only place where you meet patients, clients, or customers.

Generally, deductions for a home office are based on the percentage of your home devoted to business use. So, if you use a whole room or part of a room for conducting your business, you need to figure out the percentage of your home devoted to your business activities.

If the use of the home office is merely appropriate and helpful, you cannot deduct expenses for the business use of your home.

Mortgage Interest, Real Estate Taxes & Mortgage Insurance will not be accounted for twice. Instead, the remaining amount of unused expense that isn’t used for the home office expense will apply to Schedule A (Itemized Deductions).

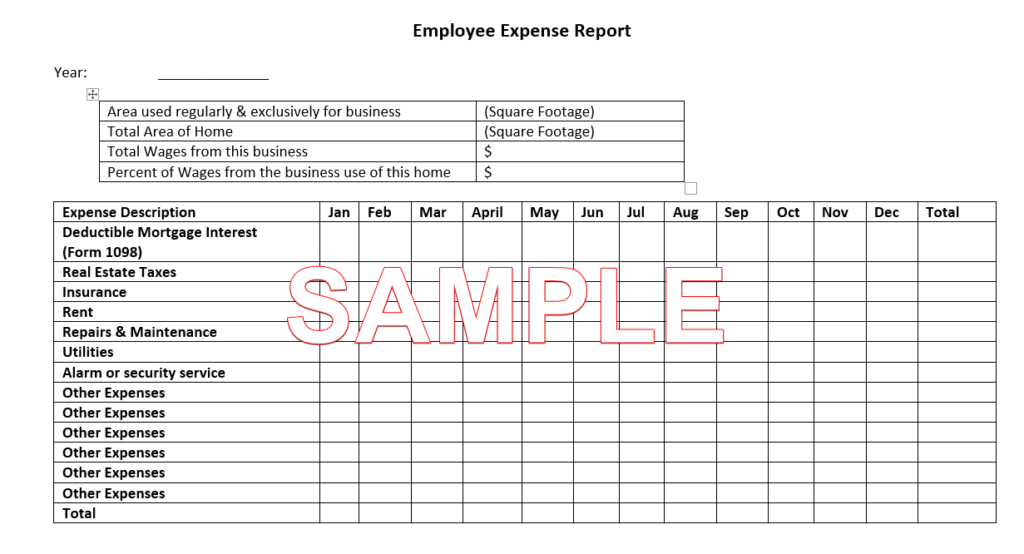

Regular Method Required Information

| Area used regularly & exclusively for business | (Square Footage) |

| Total Area of Home | (Square Footage) |

| Total Wages from this business | $ |

| Percent of Wages from the business use of this home | $ |

| Deductible Mortgage Interest (Form 1098) | $ |

| Real Estate Taxes | $ |

| Insurance | $ |

| Rent | $ |

| Repairs & Maintenance | $ |

| Utilities | $ |

| Other Expenses | $ |

| Other Expenses | $ |

| Other Expenses | $ |

| Other Expenses | $ |

| Other Expenses | $ |

Home Office Expense (Individuals who don’t have Businesses)

While you may be using your home as a home office, if you have are a W2 employee this expense will not benefit you, per the current tax law. The home office expense used to be claimable under Schedule A (Itemized Deductions) > Form 2106 (Unreimbursed Employee Expenses) > Employee Home Office. However after the Tax Cuts & Jobs Act, the expense is now disallowed on the Federal return. It may have little to no impact on the State Return.

Home Office Expense (S-Corp, Partnership, C-Corp)

If you are an employee of your own one-man corporation, whether a regular “C” corporation or a “sub-chapter S” corporation, you have several choices for handling the costs of a qualifying home office:

- The S corporation can pay you rent for the home office. (If this option is chosen, the income is taxable under your Individual Tax Return’s Schedule E)

- The S corporation can pay you for the costs of a home office under an “accountable” plan for employee business expense reimbursement.

Accountable plan for S-corporation deductions and reimbursements

The second option, being reimbursed under an accountable plan, provides the greatest tax savings. It is an excellent way to get money out of your closely-held corporation tax-free. The corporation can deduct the amount of the reimbursement and you do not have to report the payment on your personal income taxes.

This option is “more better” than having the corporation pay you rent for the home office. While your corporation can deduct the rent paid to you, you must report the rent as income on Schedule E.

To qualify as a home office, the space (it does not have to be an entire room) must be used regularly (on a continuous, ongoing or recurring basis) and exclusively (there can be no personal use) for your trade or business, and it must be your principal place of business or a place where you physically meet with patients, clients or customers on a regular basis. The space will be considered your principal place of business if it is used for performing administrative or management activities, such as billing, bookkeeping, ordering supplies, setting up appointments and writing reports, and there is no other fixed location where you regularly perform these activities.

As an employee the home office must be for the convenience of your employer. This means the home office is required as a condition of employment, it is necessary for the business to function or it is necessary for you to properly perform your duties as an employee. If you do not have any other place of business, such as a rented office or storefront, your home office should qualify.

Example:

I used to rent an office for my tax practice. Even though I did administrative work in a “regular and exclusive” space at home, and on rare occasions met with clients there, I could not claim a home office deduction or be reimbursed for home office expenses. I have since given up the rented office and work exclusively out of my home. I now have a home office that qualified for a home office deduction.

For an expense reimbursement plan to be considered “accountable,” the expenses that are reimbursed must be for actual job-related expenses (you cannot reimburse personal expenses) and you, as the employee, must substantiate the expenses by providing your employer with receipts or other documentation. Under TCJA, this is only available for independent contractors and not employees.

You should create a monthly “Employee Expense Report” form for your corporation. This is a good idea whether or not you have a home office. Start out with lines for business mileage and other out-of-pocket business expenses, such as postage, office supplies, parking and tolls, meals and entertainment, etc. Staple receipts for these items to the report.

Include a Home Office section in the report. Calculate the “business use percentage” of your home office by dividing the square footage of the office area by the total square footage of the home. List each item of expense paid during the month, such as:

- real estate taxes

- homeowner’s insurance

- oil heat, gas and electric

- water and sewer

- alarm or security service

- garbage disposal

- general repairs and maintenance

- mortgage interest (taken from the monthly mortgage billing statement or a loan amortization statement you can create online)

Multiply the total of these expenses by the business use percentage to determine the amount to be reimbursed. Total up all the business expenses listed on the form, including the home office amount, and write a check from the corporation to yourself for this amount. To be clear, this only applies if you claim the home office deduction if you have your own business and use a portion of your home for your business. It is no longer allowed for employees under TCJA.

You must reduce the amount of your itemized deduction for real estate taxes and mortgage interest by the amount of reimbursement you receive from your corporation during the year for these items. If your real estate taxes for the year are $10,000, but in the course of the year you were reimbursed $2,000 by the corporation, you can only deduct $8,000 in real estate taxes on Schedule A.

See the next page for a template for the Monthly “Employee Expense Report” form. This has to be provided to the tax accountant for preparation of your corporation return.

Download this file here: